How to Review a Pitch Deck Like a Startup Investor in 5 Steps

Learn how to master your pitch deck review in 5 steps. Enhance business metrics and stories to captivate investors before your pitch.

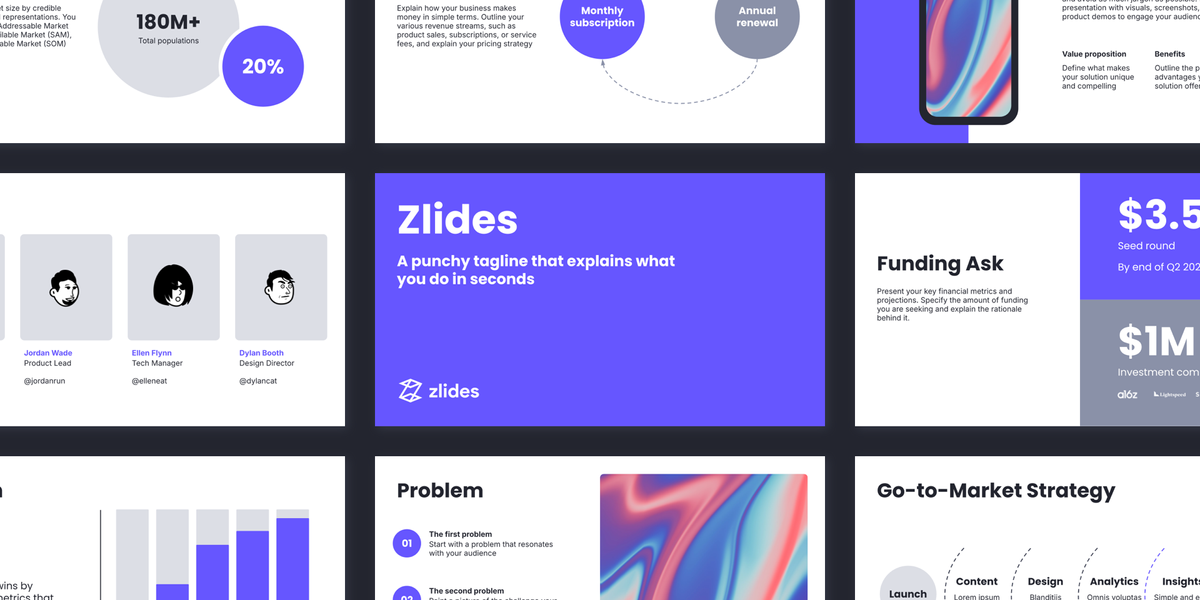

Your pitch deck needs to hook investors in the first few seconds and leave them wanting more! A good pitch deck isn't just about pretty slides; it's your startup's story wrapped in a package that makes investors sit up. Think of it as your startup's Instagram stories that need to nail three things: a story that grabs attention, numbers that prove you're onto something big, and evidence that your team can make it happen.

Investors typically spend 2-5 minutes deciding if your startup is worth a deeper look. That's why knowing how to craft your pitch deck from an investor's point of view is extremely important - it's essential for standing out from the crowd and getting that all-important meeting.

Key Elements Investors Evaluate in a Pitch Deck

When conducting a pitch deck review, investors typically focus on three core aspects: the story, the numbers, and the team. A compelling narrative keeps investors engaged while concrete metrics prove your business model works. The team's expertise demonstrates your ability to execute the vision.

Remember, investors see hundreds of pitch decks annually and spend just a few minutes or less on every deck, you’re not special! Your pitch deck assessment needs to quickly communicate your value proposition while maintaining enough depth to answer critical questions.

The 5 Essential Steps to Review a Pitch Deck

Step 1: Evaluate the Story and Narrative

Start by assessing how well the pitch deck flows from one idea to the next. Does the story captivate from the first slide? Look for a clear, compelling narrative that explains why this startup exists and where it's heading.

The best pitch decks tell a story that's emotionally engaging and logically sound. Check whether the presentation maintains a consistent tone and if each slide builds upon the previous one.

Step 2: Analyze the Business Problem and Solution

Every great business solves a real problem. When doing your pitch deck review, ask yourself: Is the problem big enough that people will pay for a solution? The solution should be clearly explained without technical jargon.

Look for evidence that the team deeply understands their target customers' pain points. The solution should offer a compelling value proposition that's different from existing alternatives in the market.

Step 3: Assess the Market Opportunities

Market size matters, but accuracy matters more. Review how the startup estimates its Total Addressable Market (TAM). Are the assumptions realistic and well-researched?

Pay attention to the competitive landscape analysis. A good pitch deck shows awareness of both direct and indirect competitors, along with a clear strategy for differentiation.

Step 4: Examine Traction Metrics and Key Indicators

Numbers tell the truth about a startup's progress. Look for key metrics that demonstrate growth, such as user acquisition, revenue, engagement, growth rates, or other relevant indicators for the specific business model.

Stay away from vanity metrics that look impressive but don't reflect real business value. Focus on metrics that show product-market fit and sustainable growth.

Step 5: Assess the Founding Team's Qualifications

A stellar team can execute even an average idea successfully. Evaluate the founders' and key team members' relevant experience and track record. Look for complementary skills among team members and their ability to adapt and learn.

Check if the team has any unique knowledge or unfair advantages in their market. Previous startup experience, industry expertise, or strong network connections are valuable assets.

Remember the Following

Mistakes to Avoid When Pitching to Investors

Common pitfalls include overwhelming slides with too much text, using complicated technical jargon, and making unrealistic financial projections. Avoid these by keeping content clear and concise.

Another frequent mistake is focusing too much on the product features rather than the business opportunity. Remember, investors care about how you'll make money, scale the business and eventually driving returns on investment.

Strive for Clarity Over Perfection

Don't get caught up in making every slide perfect. Focus instead on clearly communicating your key messages. A simple, well-structured pitch deck often outperforms a flashy but confusing one.

Use visuals effectively to support your message, not distract from it. Charts, graphs, and images should make complex information easier to understand.

Understand Your Investor's Perspective

Different investors have different priorities. Angel investors might focus more on the team and vision, while venture capitalists typically examine metrics and market size more closely.

Put yourself in the investor's shoes: they're looking for returns on their investment. Make sure your pitch deck clearly shows the path to profitability and exit opportunities.

Investors Back People, Not Just Ideas

Show your passion and commitment to the business, but remain professional. Your pitch deck should reflect both your enthusiasm and your business acumen.

Demonstrate that you're coachable and open to feedback. Investors want to work with founders who can take guidance and adapt to changing market conditions.

Showcase Your Expertise and Industry Knowledge

Prove you understand your market inside and out. Include relevant industry trends, regulatory considerations, and market dynamics that affect your business.

Highlight any unique insights or advantages you have in your space. This could be proprietary technology, strategic partnerships, or specialized knowledge that sets you apart.

Remember, a great pitch deck is just the beginning of your fundraising journey. It's a tool to start meaningful conversations with investors and showcase your startup's potential. Keep refining your story, updating your metrics, and adapting your pitch based on feedback.

Frequently Asked Questions

How to evaluate a pitch deck?

First, understand the startup's main idea: What problem are they solving? Then, look at the team: Are they qualified? Check the market: Do people need this? Review the numbers: Are they realistic? Finally, get an overall impression: Is the story interesting and reasonable?

How to give feedback on a presentation?

Be specific about what's good and bad. Focus on the main content and visuals. Suggest ways to improve, not just spotting errors. Be honest, but kind. Think about what the audience would understand.

What should a good pitch deck look like?

A good pitch deck should clearly explain your business. Use simple language and helpful visuals. Tell a story about the problem, your solution, and the market. Emphasize the most important information. Keep it clean, professional, and easy to understand.

A strong pitch deck review skill is your secret weapon to see your startup through an investor’s eyes. When you understand how investors evaluate your story, numbers, and team, you can tailor your deck to grab their attention fast. This matters because investors decide quickly, often in just minutes, whether your startup deserves a deeper look.

By mastering the art of pitch deck review skill, you’re not just polishing slides, you’re shaping a clear, compelling narrative that highlights your unique value and potential. This insight gives you a real edge in standing out and opening doors to funding opportunities.

If you want to take your pitch deck to the next level, why not book a session to review your pitch deck together? I’ll help you spot what works, what needs tweaking, and how to make your story unforgettable. Let’s make sure your pitch deck truly shines and gets the investor interest you deserve.

Get a Professional Pitch Deck and Tell Compelling Stories

✓ Unique layouts ✓ Editable elements ✓ Free vector icons ✓ Compatible with Google Slides

Download now →Related Posts