How to Create an Ask Slide for Your Pitch Deck

An ask slide boosts fundraising success in your pitch deck. Learn how to create a compelling one for investors effectively.

What if your Ask slide could turn sceptical investors into believers? Crafting a strong ask slide, also known as a funding slide, is crucial for securing investment. This slide is the climax of your pitch deck, where you clearly communicate your funding needs and convince potential investors of your business's viability and growth potential. But what exactly is an ask slide, and how can you create one that resonates with investors? Let's dive in to find out!

Why is the Ask Slide Important

The ask slide is more than just a funding request; it's designed to help investors understand your business goals and how their investment will drive growth. By clearly communicating your funding needs should align with your business model slide to show how the investment drives revenue. This slide is your chance to showcase your roadmap to success, underpinned by a well-thought-out financial plan on your pitch deck.

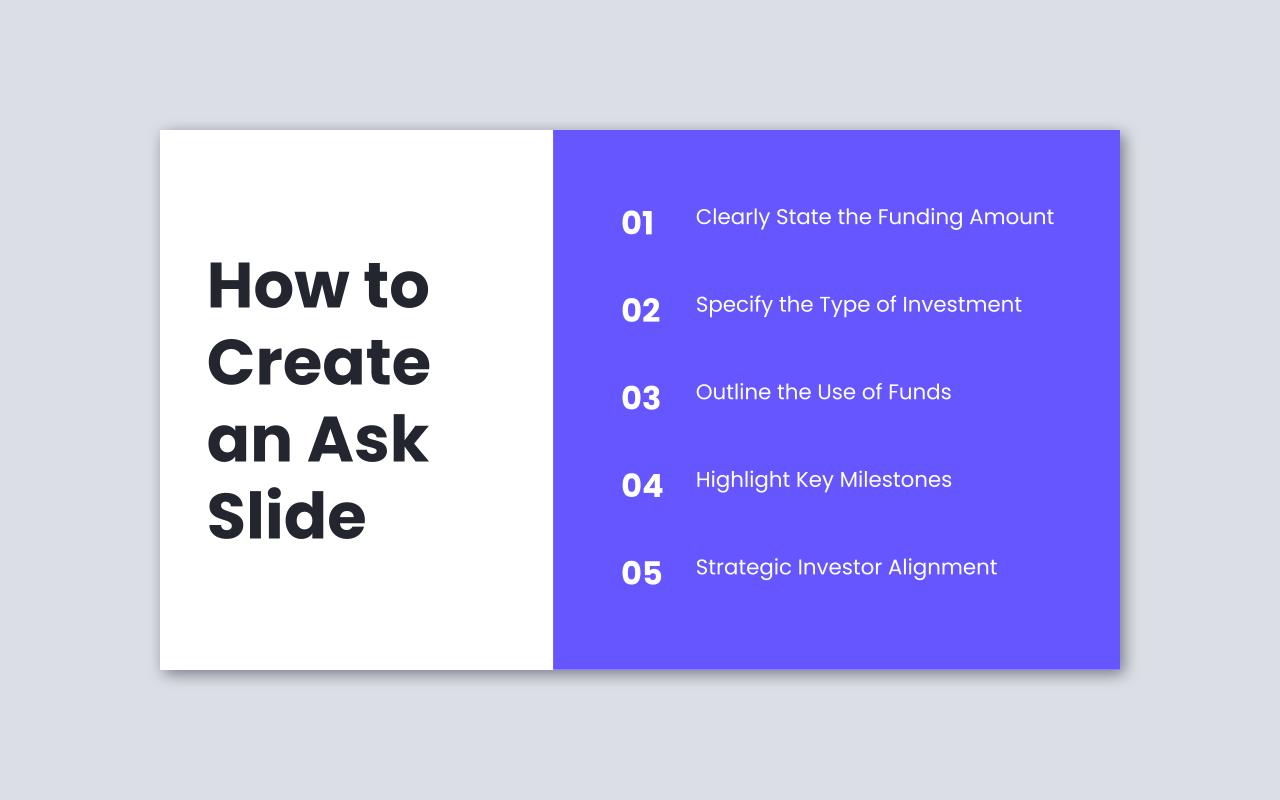

How to Create an Ask Slide

Clearly State the Funding Amount

Clearly display the amount you are raising and indicate the stage of investment. If there's flexibility, provide a range and explain why. For example, "We are raising $2 million in Series A funding to support our product launch and market expansion."

Specify the Type of Investment

Indicate the investment structure, such as equity round, convertible note, SAFE, or debt financing, and include relevant terms like valuation cap or interest rate. This clarity helps investors understand the terms of the investment and what they can expect in return.

Outline the Use of Funds

Break down how the funds will be allocated, such as product development, marketing, or hiring. Use visuals like pie charts or infographics to illustrate this. For instance:

- Product Development: $800,000 (40%)

- Marketing and Sales: $600,000 (30%)

- Hiring: $400,000 (20%)

- Operational Expenses: $200,000 (10%)

Highlight Key Milestones

Ensure that your funding request aligns with your financial projections and business strategy. This shows investors that the funding is necessary for achieving your growth goals. For example, "With this funding, we aim to launch our product by Q2, expand our marketing efforts to reach 1 million users, and hire key personnel to support our growth."

Strategic Investor Alignment

Emphasize how the investor's focus, expertise, or network aligns with your startup's goals and industry. For example, "We believe [Investor's Name] is the ideal partner due to their extensive experience in [specific area], which complements our mission to [briefly describe your startup's mission].”

"Remember that you’re giving the investor a percentage of the business with the potential for huge returns, but in order for that to happen the business needs to succeed." as Jeff Becker once said on How To Raise A Pre-Seed Round. Securing investment requires not just a promising idea, but a viable path to success that can deliver substantial returns, making the business's potential for growth crucial for both parties.

Mistakes to Avoid

Failing to Quantify Milestones and Use of Funds

Not specifying how funds will be allocated or what milestones will be achieved can make your request seem vague. Quantify outcomes and provide a clear breakdown of fund allocation to demonstrate a well-thought-out plan.

Bad Example: A vague statement like "We need $2 million to grow our business" lacks clarity and fails to convince investors of your strategic plan.

Good Example: Instead, you could say, "We are seeking $2 million, which will be allocated as follows: $800,000 for product development, $600,000 for marketing, $400,000 for hiring, and $200,000 for operational expenses. With this funding, we aim to launch our product by Q2 and reach 1 million users by Q3.”

Including Unrealistic Information

Avoid including valuations prematurely or listing specific runway times without a lead investor. Also, refrain from being overly technical or generic in your ask.

Bad Example: "We're valued at $10 million and need funding to last us two years."

Good Example: "We are seeking $2 million at a pre-money valuation of $8 million. This funding will support our growth strategy and drive key milestones."

Insufficient Context

Not providing enough context about why the funding is needed or how it fits into your overall business strategy can leave investors uncertain about the potential return on investment. Ensure that you explain how the funds will drive growth and profitability.

Bad Example: "We need funding to grow."

Good Example: "We are seeking $2 million to enhance our product development and expand our marketing efforts. This investment will drive revenue growth by 50% within the next year and position us for market leadership."

Frequently Asked Questions

What should my ask slide include?

State the amount you’re raising, planned use of funds (with clear milestones), and your expected runway. Be specific and show how each dollar enables concrete growth.

Should I mention previous fundraising on my ask slide?

Yes, include amounts previously raised and significant investors to demonstrate traction and validation. Show what you achieved with earlier funds.

What’s the most common mistake with this slide?

Failing to connect the fundraising need to milestone achievements. Always link the ask to a credible action plan for value creation.

The Short of It

Wrapping up your pitch with a strong ask is key to leaving a lasting impression. Knowing how to wrap up a pitch, the ask, means clearly stating what you need and why it matters, not just to you, but to your potential investors. This clarity helps them see the path to growth and the value their investment can unlock. So, when you nail this part, you’re not just asking for money, you’re inviting partners to join your journey. If you want a little extra help making your ask slide shine, feel free to download our easy-to-use pitch deck template. It’s designed to guide you step-by-step, so you can confidently close your pitch and open the door to new opportunities.

Get a Professional Pitch Deck and Tell Compelling Stories

✓ Unique layouts ✓ Editable elements ✓ Free vector icons ✓ Compatible with Google Slides

Download now →