How to Create a Market Slide for Your Pitch Deck

A market slide showcases your target market's size and growth prospects, helping investors assess scalability and viability.

Are you ready to convince investors that your startup is the next big thing? Creating a standout market slide in your pitch deck is crucial in achieving this goal. A market slide is where you showcase your target audience, market size, growth potential, and competitive landscape. This slide helps investors understand whether your business has what it takes to scale and succeed.

In this article, we'll dive deeper into why the market slide matters so much for new startup founders like you. We'll explore how to create an effective one that will leave investors eager to learn more about your venture.

Why Is the Market Slide Important?

The market slide provides essential insights about your business. By presenting robust statistics, you demonstrate not only the viability but also the scalability of your business model.

- Substantial Market Opportunities: Investors seek substantial market opportunities to ensure significant returns, typically aiming for at least 5-10 times their initial investment.

- Growth Potential: A key factor is whether there's enough room for growth in your chosen market sector and audience segment.

- Enhances Credibility: A well-researched market slide demonstrates that you have a deep understanding of your market and competition, enhancing your credibility with potential investors.

How To Create A Market Slide

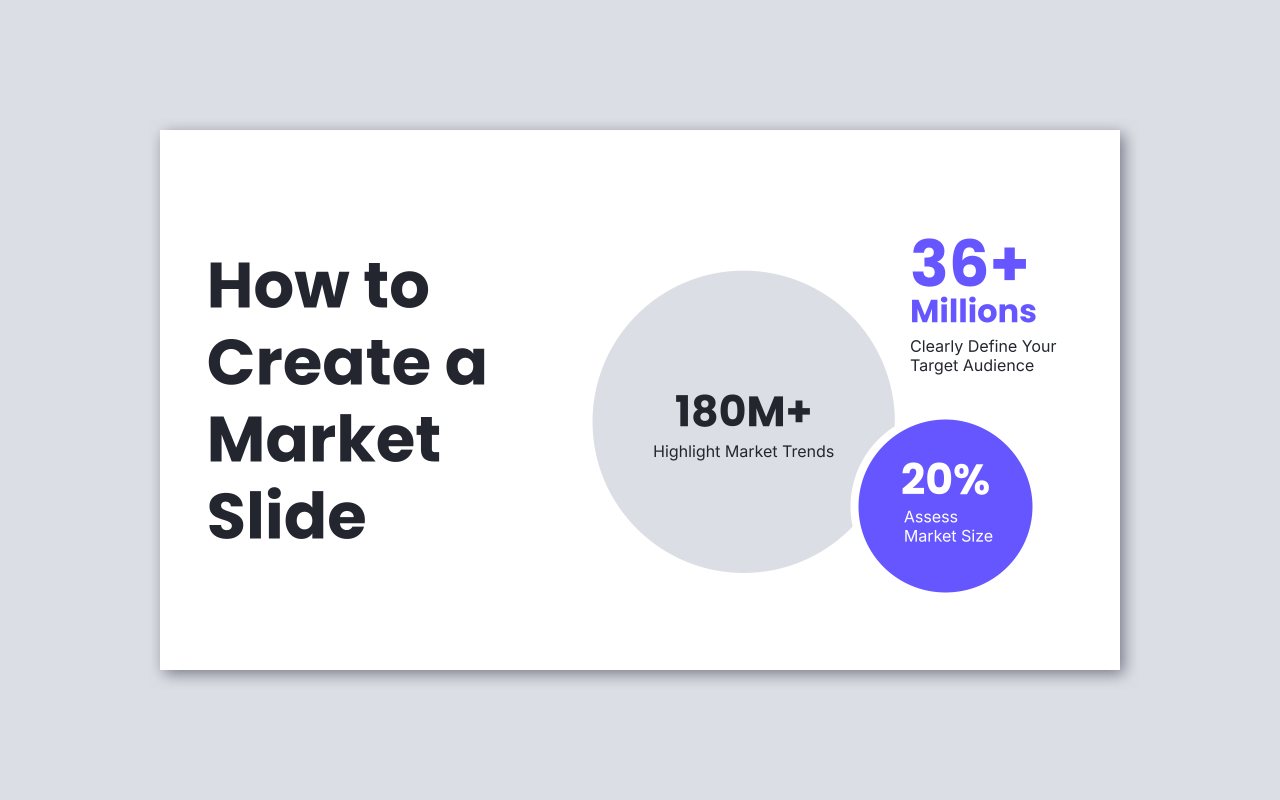

Clearly Define Your Target Audience

Identifying who your customers are is vital. You need specific details about which segments they belong to (e.g., demographics, industries, behavioural segments) and what needs they have. This focused approach shows investors you understand exactly who will benefit from what you offer.

Assess Market Size

Here’s where TAM (Total Addressable Market), SAM (Serviceable Available Market), and SOM (Serviceable Obtainable Market) come into play:

- TAM: The total revenue opportunity if everyone bought from you.

- SAM: The portion of TAM that aligns with what you offer.

- SOM: The realistic share of SAM achievable within a your resources.

These metrics help quantify potential revenue opportunities effectively.

Highlight Market Trends

Discuss relevant trends using data-driven insights:

- Show how these trends indicate rapid growth or emerging opportunities.

- Use statistics or forecasts from reputable sources like industry reports or research studies.

This demonstrates urgency around solving problems in this space now rather than later!

Show Competitive Landscape

Include an analysis of competitors:

- Outline their current share in the market.

- Highlight how differently positioned they are compared to yours.

Illustrate unique selling points or advantages over existing solutions.

Growth Strategy And Projection

Outline plans for capturing more share:

- Detail go-to-market tactics: social media campaigns vs traditional advertising.

- Discuss sales strategies: direct sales vs partnerships with distributors.

Estimate realistic growth rates based on historical data or similar industries' benchmarks. Explain clearly why there’s a significant revenue opportunity waiting for grabs!

"If you can’t make the case that you’re addressing a possible billion dollar market, you’ll have difficulty getting VCs to invest." as Tren Griffin shared 12 Things He Learned from Chris Dixon about Startups. It is important for startups to demonstrate potential for massive scalability and market impact, as venture capitalists typically invest in opportunities with billion-dollar market potential.

Mistakes To Avoid

Lack Of Research

Failing to conduct thorough research can lead your pitch astray. It's crucial to understand your target audience thoroughly.

Bad Example: Assuming all young adults are equally interested in eco-friendly products without researching further.

Good Example: Conducting surveys that reveal 60% of environmentally conscious consumers are actually between 35 and 50 years old, allowing for targeted marketing.

Overestimating Market Size

Inflating market size figures can damage credibility. Investors prefer realistic projections backed by solid data over exaggerated claims.

Bad Example: Claiming to capture 50% of a major market without evidence.

Good Example: Projecting a realistic market share based on historical data and industry benchmarks, such as capturing 5% of the New York City food delivery sector within two years.

Inaccurate Data And Statistics

Presenting incorrect information undermines trust instantly. Ensure that your data is up-to-date and reflects current market conditions.

Bad Example: Using outdated statistics suggests rapid growth when the market has plateaued.

Good Example: Citing recent reports showing stable growth trends, such as a 5% annual increase in demand after adjusting for regulatory changes affecting demand negatively. For instance, referencing a study from Q4 last year that highlights these adjustments and their impact on industry forecasts.

Frequently Asked Questions

What market data matters most to investors?

Show Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM). Highlight market size, growth rate, and credible sources.

Can I use competitor or case study data in my market slide?

Absolutely. Use examples and statistics from similar high-growth companies to demonstrate demand and adoption potential. Investors want evidence your market exists and is accessible.

How detailed should my market analysis be?

Prioritize clarity one slide backed by solid data is more convincing than several crowded with vague info. Use charts or bullet points to highlight only the most critical numbers.

The Short of It

Creating a strong market slide is essential to show investors the real potential of your business. This slide highlights your target audience, market size, growth opportunities, and where you fit among competitors. Why does this matter? Because investors want to see that your startup can grow and deliver solid returns in a sizable market.

If you’re ready to make your pitch deck stand out, try downloading a free pitch deck template. It’s an easy way to start building a clear, convincing market slide that speaks directly to investors. You’re on your way to telling a story that truly connects.

Get a Professional Pitch Deck and Tell Compelling Stories

✓ Unique layouts ✓ Editable elements ✓ Free vector icons ✓ Compatible with Google Slides

Download now →